Contents

But if the reading is under 20, it’s considered oversold and provides an entry point to buy. All three indicators are represented as three separate lines as illustrated below. The ‘standard line’ in blue calculates the average of the highest high and the lowest low for the past 26 sessions. The ‘turning line’ is highlighted in red and is the average of the highest high and lowest low for the past 9 sessions.

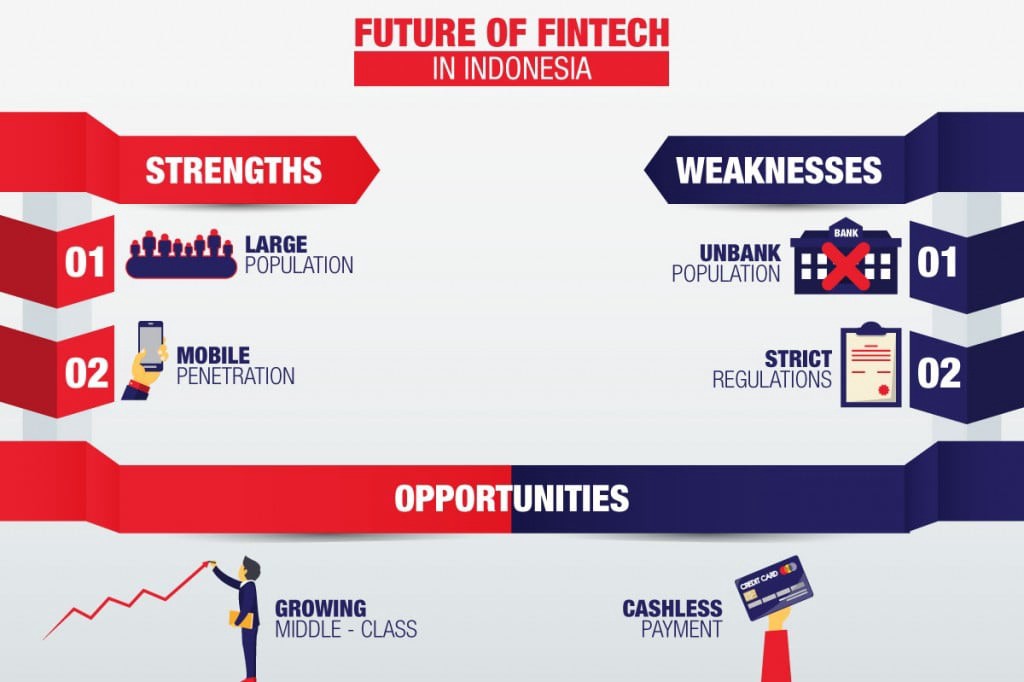

While scalpers may trade on news events or small fundamental changes, they primarily focus on technical indicators and charts. This guide will examine scalp trading, otherwise known as scalping. It will present the reader with the five best scalping https://1investing.in/ strategies, tips, and tricks for beginners, as well as the pros and cons of using this trading method. The strategy works best in trending markets, making it a good choice for popular currency pairs on a 1-minute or 5-minute time frame.

Now that you know who scalpers are, you must be wondering how scalping trading strategy works. The stochastic indicator is a momentum oscillator used to pinpoint potential trend reversals. It uses a reading of to indicate when to buy or sell the financial asset. If the reading is over 80, it’s considered overbought and an exit point to sell.

However, some brokerages choose not to support it because it requires placing a high volume of trades in a short period. Other brokerages allow scalping but have additional rules and restrictions for investors that use this strategey. That may cause some to believe that scalping trading is illegal. Scalping is a very short-term trading Executive summary method with timeframes anywhere between one and 15 minutes. This is because price movements are typically minimal, so entry and exit points need to be sharp. Market making is the most challenging scalping strategy to execute successfully, as the scalper must compete with market makers for the shares on both bids and offers.

Do scalpers just work in the FX market?

However, in an attempt to minimize risk by pursuing small wins, traders may miss out on larger gains. This type of scalp trading is done by purchasing a considerable amount of shares and then reselling them for a gain on a tiny price difference. Arbitrage sees the trader enter into trades for thousands of shares, waiting for a small move, typically measured in cents. Like scalpers, day traders also make several trades during the day. The scalping trading strategy you choose may not be a quick decision and it will take some thorough research and practice to find the best fit.

That’s the difference between the price a broker will buy a security from a scalper and the price the broker will sell it to the scalper. Scalping requires account equity to be greater than the minimum $25,000 to avoid the pattern day trader rule violation. David Jaffee provides a comprehensive online options trading course that teaches beginners and advanced traders how to earn money by selling options. Even the best scalpers are engaging in a n activity that has a probability of profit equal to a coin flip, assuming zero transaction costs and no slippage. And when you factor in the opportunity cost of your time and education, it’s no wonder that virtually all retail scalpers are unable to earn consistent profits and end up losing money.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Just because the positions are short-lived doesn’t guarantee a profit. A currency pair or CFD can quickly change and move in the opposite direction. Due to the sheer volume of trades executed throughout the day , commissions and/or fees are also high (e.g. having to pay the spread between a buy and a sell trade). It will be difficult to earn money scalping if you continue to use a broker that costs $ 10 (or more!) in trading commissions.

- The most obvious way is to use it when the market is choppy or locked in a narrow range.

- Scalpers should trade highly liquid and volatile stocks, as it will allow them to enter and exit trades fast.

- However, some brokerages choose not to support it because it requires placing a high volume of trades in a short period.

- Automatic, instant execution of orders is crucial to a scalper, so a direct-access broker is the preferred method.

- As scalping uses small timeframes, traders need to be able to act quickly on trades to secure a profit in good time.

Finally, the ‘lagging line’ in green is the closing price plotted 26 sessions behind. There are no charges or any bulk savings — Scalpers can make hundreds of trades in a single day. Increased transaction expenses would soon eat into your earnings.

How profitable is Scalping?

Price action scalper uses indicators like line, bar charts, candlesticks, etc., which is another strategy used by traders who want to make quick money from forex. Price action can help you view supply and demand like no other tool. And, forex being the most liquid market globally, the potential to scalp and generate profits is abysmal. Scalpers generally try to limit their risk by exiting their positions quickly. Suppose a scalper buys 1,000 shares of stock at $5.50 per share and sells it when it reaches $5.60 per share, for a profit of $100.

To assess market momentum, investors employ a variety of technical indicators. They must be focused, dedicated, disciplined, alert, fast, and decisive enough to make the most out of the small changes in stock prices. If scalpers miss out on the unfavorable price movements, they may incur avoidable losses. The nature of scalping means that it can only be done successfully in markets that meet certain conditions.

What Are Some Scalping Trading Strategies?

1000 financial assets that range from Stocks and Forex to Indices, Commodities, and Cryptocurrencies. This ensures that investors have a wide selection of trading instruments that are ideal for scalping as well as various other trading strategies. The goal of scalping is to capture small profits by taking advantage of small price movements in the market. Scalpers open a large number of trades with the hope that the small profits captured will eventually add up to a large profit amount at the end of the trading session or trading day.

As a rule, all trading strategies require rigour and discipline, but these qualities double their importance with scalping. Scalping is a trading strategy that traders deploy to earn small profits from market fluctuations, often through large-volume trades many times during the market session. Though not as risky as day trading, one should thoroughly understand the markets and stock they chose to scalp. Large volumes also pose a high risk to capital should the strategy fail. Reach out to your financial advisor before initiating any positions or trade.

TRADING METHODS SUCH AS SCALPING AND OTHERS.

Scalpers, especially on turbulent days, might frequently trade the same securities many times throughout a session. Learners should aim for the most liquid equities available when learning the scalping method. To do the most complex kinds of scalping, you’ll need recourse to 1-minute charts, Phase 2 quotations, and exchange order books. Both Jaya and Shyam Mohini conducted fraudulent and unfair trade practices based on Hemant’s buy recommendations made on the show, impacting the share price and volume. The order barred them from trading in the securities market or engaging in any investment-related activities.

Despite this, scalping is a popular trading method used by many investors across different markets. Scalping is permissible if traders are speculating on price changes and not manipulating the market. You’ll be stuck with too many transaction expenses to make the approach viable if you’re not using a broker that offers direct access to markets or low/free charges. If stocks are difficult to move, your strategy might backfire if you’re going to hang on for longer than expected. To find the optimum entry opportunities, use analytical trading signals like moving averages and stochastic oscillators to obtain the quickest potential trade execution. Scalpers prefer liquid markets over stable ones, as opposed to momentum traders.

Levels of Support and Resistance

You need to know exactly where and when your trade will be executed when you’re trading multiple shares every day. As a result, it is one of the most common scalping strategies among scalpers. In addition, instead of waiting to see if the trade comes around, scalpers exit trades when their goal loss threshold is reached. Rather than waiting to see whether they can earn more, scalpers exit trades once their profit objective has been met. Scalping is a form of trading strategy that necessitates a high level of discipline as well as an excellent risk management system.

You need to have a technique in place, and this should correspond with your financial aims, tolerance of risk, time to spend on investments, plus other factors. Scalping is one particular style that you can consider adopting when you start out. Scalping meaning simply refers to undertaking many small deals during a market day, with the goal of making a profit. Time frame– Scalpers operate on a very short time frame, looking to profit from market waves that are sometimes too small to be seen even on the one-minute chart.

Scalping takes time to perfect, but it’s a valuable skill to have, especially if markets are trading sideways for a long period of time. Scalpers might easily lose their profits due to high transaction fees. It will be difficult to generate higher profits if you continue to use a broker that charges you a high transaction fee. Scalping isn’t for you if you’re seeking a long-term profit in a quick time. You’ll also need nimbleness to get out of non-working transactions.

コメント